Motorola Solutions, Inc. (NYSE: MSI) today reported its earnings results for the second quarter of 2022.

“Q2 was exceptional across the board, with record second-quarter revenue,” said Motorola Chairman and CEO Greg Brown. “Our Q2 record-ending backlog and continued strong operational execution are driving our increased expectations for the full year.”

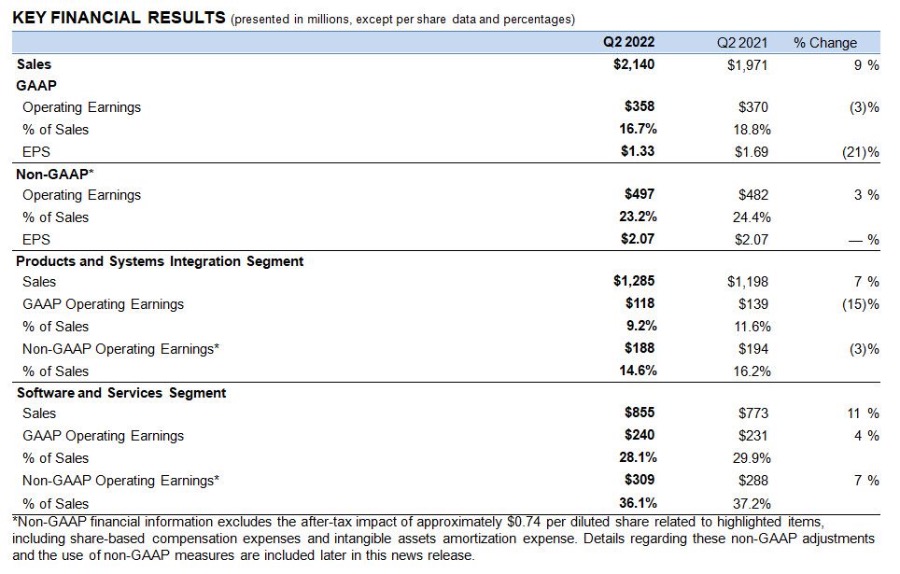

Sales were $2.1 billion, up 9% from the year-ago quarter, driven by growth in North America. Revenue from acquisitions was $34 million and currency headwinds were $44 million in the quarter.

The products and systems integration segment grew 7%, driven by growth in LMR and video security and access control (video). The software and services segment grew 11%, driven by growth in video, command center software and LMR services.

Generally accepted accounting principles (GAAP) operating margin was 16.7% of sales, down from 18.8% in the year-ago quarter. Non-GAAP operating margin was 23.2% of sales, down from 24.4% in the year-ago quarter. The decrease in both GAAP and non-GAAP operating margins was primarily due to the impact of higher direct material costs for semiconductors and higher operating expenses for acquisitions, partially offset by higher sales.

The GAAP effective tax rate was 23.7%, up from 13.5% in the year-ago quarter, primarily driven by a partial release of a valuation allowance recorded on the U.S. foreign tax credit carryforward in the second quarter of 2021. The non-GAAP effective tax rate was 22.3%, up from 20.5% in the year-ago quarter, driven primarily by lower benefits from discrete items in the current quarter.

Operating cash flow was $10 million, compared to $388 million in the year-ago quarter. Free cash flow was a usage of $49 million, compared to $326 million of free cash flow generated in the year-ago quarter. Both the operating cash flow and free cash flow for the quarter decreased primarily due to an increase in inventory, higher employee incentives and higher cash taxes in the current quarter.

During the quarter, the company repurchased $162 million of shares, paid $132 million in cash dividends and incurred $59 million of capital expenditures. Additionally, the company closed the acquisitions of Calipsa for $40 million and Videotec for $22 million, each net of cash acquired. The company also issued $600 million of long-term debt during the quarter and used a portion of the proceeds to retire $275 million of outstanding senior notes.

The company ended the quarter with record second-quarter backlog of $13.4 billion, up 19% or $2.2 billion from the year-ago quarter, inclusive of $496 million of unfavorable currency. Products and systems integration segment backlog was up 30%, or $986 million. The growth was primarily driven by strong LMR and video demand. Software and services segment backlog was up 15% or $1.2 billion, driven by the extension of the Airwave contract in the fourth quarter of 2021 and an increase in multi-year software and services contracts in North America, partially offset by $436 million of unfavorable currency.

For the third quarter 2022, the company expects revenue growth of approximately 10%, compared to the third quarter of 2021. The company expects non-GAAP earning per share (EPS) in the range of $2.85 to $2.90 per share. This assumes approximately $60 million in foreign exchange headwinds, approximately 172 million fully diluted shares, and an effective tax rate of approximately 20%.

For the full year of 2022, the company now expects revenue growth of approximately 8%, up from its prior guidance of approximately 7% and non-GAAP EPS between $10.03 and $10.13 per share, up from its prior guidance of between $9.80 and $9.95 per share. This outlook assumes approximately $170 million in foreign exchange headwinds, approximately 172 million fully diluted shares and an effective tax rate of 21% to 21.5%.